Early career

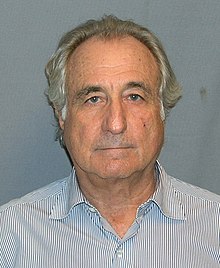

Madoff founded the Wall Street firm Bernard L. Madoff Investment Securities LLC in 1960. He was its chairman until his arrest on December 11, 2008.[13]

The firm started as a penny stock trader with $5,000 ($37,000 in current dollar terms) that Madoff earned from working as a lifeguard and sprinkler installer.[51] He further secured a loan of $50,000 from his father-in-law which he also used to set up Bernard L. Madoff Investment Securities LLC. His business grew with the assistance of his father-in-law, accountant Saul Alpern, who referred a circle of friends and their families.[59] Initially, the firm made markets (quoted bid and ask prices) via the National Quotation Bureau's Pink Sheets. In order to compete with firms that were members of the New York Stock Exchange trading on the stock exchange's floor, his firm began using innovative computer information technology to disseminate its quotes.[32] After a trial run, the technology that the firm helped develop became the NASDAQ.[60]

The firm functioned as a third-market provider, which bypassed exchange specialist firms, by directly executing orders over the counter from retail brokers.[16] At one point, Madoff Securities was the largest market maker at the NASDAQ and in 2008 was the sixth largest market maker on Wall Street.[32] The firm also had an investment management and advisory division, which it did not publicize, that was the focus of the fraud investigation.[61]

Madoff was "the first prominent practitioner"[62] of payment for order flow, in which a dealer pays a broker for the right to execute a customer's order. This has been called a "legal kickback."[63] Some academics have questioned the ethics of these payments.[64][65] Madoff has argued that these payments did not alter the price that the customer received.[66] He viewed the payments as a normal business practice: "If your girlfriend goes to buy stockings at a supermarket, the racks that display those stockings are usually paid for by the company that manufactured the stockings. Order flow is an issue that attracted a lot of attention but is grossly overrated."[66]

Madoff was active in the National Association of Securities Dealers (NASD), a self-regulatory securities industry organization and has served as the Chairman of the Board of Directors and on the Board of Governors of the NASD.[14]

Government access

Since 1991, Madoff and his wife have contributed about $240,000 to federal candidates, parties and committees, including $25,000 a year from 2005 through 2008 to the Democratic Senatorial Campaign Committee. The Committee has returned $100,000 of the Madoffs' contributions to Irving Picard, the bankruptcy trustee who oversees all claims. Senator Charles E. Schumer returned almost $30,000 received from Madoff and his relatives to the trustee, and Senator Christopher J. Dodd donated $1,500 to the Elie Wiesel Foundation for Humanity, a Madoff victim.[67]

The Madoff family gained access to Washington's lawmakers and regulators through the industry's top trade group. The Madoff family has long-standing, high-level ties to the Securities Industry and Financial Markets Association (SIFMA), the primary securities industry organization.[68] Bernard Madoff sat on the Board of Directors of the Securities Industry Association, which merged with the Bond Market Association in 2006 to form SIFMA.[69]

Madoff's brother Peter then served two terms as a member of SIFMA’s Board of Directors. He stepped down from the Board of Directors of SIFMA in December 2008, as news of the Ponzi scheme broke.[68] From 2000 to 2008 the two Madoff brothers gave $56,000 to SIFMA, and tens of thousands of dollars more to sponsor SIFMA industry meetings.[70] Bernard Madoff's niece Shana Madoff was active on the Executive Committee of SIFMA's Compliance & Legal Division, but resigned her SIFMA position shortly after her uncle's arrest.[71]

In 2004 Genevievette Walker-Lightfoot, a lawyer in the SEC's Office of Compliance Inspections and Examinations, informed her supervisor branch chief Mark Donohue that her review of Madoff found numerous inconsistencies and recommended further questioning. However, because of agency pressure to investigate the mutual fund industry, she had to conclude work on the probe. Donohue's boss, Eric Swanson, an assistant director of the department,[72] married Shana Madoff, after the investigation concluded in 2005.[73] A spokesman for Swanson, who has left the SEC, said he "did not participate in any inquiry of Bernard Madoff Securities or its affiliates while involved in a relationship" with Shana Madoff.[74]

While awaiting sentencing, Madoff met with the SEC's Inspector General, H. David Kotz, who is conducting an investigation into how regulators failed to detect the fraud despite numerous red flags.[75] Madoff said he could have been caught in 2003, but bumbling investigators acted like "Lt. Colombo" and never asked the right questions.

"I was astonished. They never even looked at my stock records. If investigators had checked with the Depository Trust Company, a central securities depository, it would've been easy for them to see. If you're looking at a Ponzi scheme, it's the first thing you do." Madoff said in the June 17, 2009, interview that SEC Chairman Mary Schapiro was a "dear friend," and SEC Commissioner Elisse Walter was a "terrific lady" whom he knew "pretty well."[76]

Since Madoff's arrest, the SEC has been criticized for its lack of financial expertise and lack of due diligence, despite having received complaints from Harry Markopolos and others for almost a decade. The SEC's Inspector General, H. David Kotz, found that since 1992, there were six botched investigations of Madoff by the SEC, either through incompetent staff work or neglecting allegations of financial experts and whistle-blowers.[77][78][79]

Investment scandal

Concerns about Madoff's business surfaced as early as 1999, when financial analyst Harry Markopolos informed the U.S. Securities and Exchange Commission (SEC) that he believed it was legally and mathematically impossible to achieve the gains Madoff claimed to deliver. According to Markopolos, he knew within five minutes that Madoff's numbers didn't add up, and it took four hours of failed attempts to replicate them to conclude Madoff was a fraud.[80] He was ignored by the Boston SEC in 2000 and 2001, as well as by Meaghan Cheung at the New York SEC in 2005 and 2007 when he presented further evidence. He has since published a book, No One Would Listen, about the frustrating efforts he and his team made over a ten-year period to alert the government, the industry, and the press about the Madoff fraud.

Although Madoff's wealth management business ultimately grew into a multi-billion-dollar operation, none of the major derivatives firms traded with him because they didn't think his numbers were real. None of the major Wall Street firms invested with him either, and several high-ranking executives at those firms suspected he wasn't legitimate.[80]

Others also contended it was inconceivable that the growing volume of Madoff accounts could be competently and legitimately serviced by his documented accounting/auditing firm, a three-person firm with only one active accountant.[81]

The Federal Bureau of Investigation complaint says that during the first week of December 2008, Madoff confided to a senior employee, identified by Bloomberg News as one of his sons, that he said he was struggling to meet $7 billion in redemptions.[17] According to the sons, Madoff told Mark Madoff on December 9 that he planned to pay out $173 million in bonuses two months early.[82] Madoff said that “he had recently made profits through business operations, and that now was a good time to distribute it."[17] Mark told Andrew Madoff, and the next morning they asked their father to explain how he could pay bonuses to his staff if he was having trouble paying clients. They went to Madoff's apartment, with Ruth Madoff nearby. Madoff told them he was “finished,” that he had “absolutely nothing” left, that his investment fund was “just one big lie” and “a giant Ponzi scheme”.[82] According to their attorney, Madoff's sons then reported their father to federal authorities.[17] On December 11, 2008, he was arrested and charged with securities fraud.[19]

Madoff posted $10 million bail in December 2008 and remained under 24-hour monitoring and house arrest in his Upper East Side penthouse apartment until March 12, 2009, when Judge Denny Chin revoked his bail and remanded him to the Metropolitan Correctional Center. Chin claimed Madoff was a flight risk, because of his age, wealth, and the prospect of spending the rest of his life in prison.[83] Prosecutors filed two asset forfeiture pleadings which include lists of valuable real and personal property as well as financial interests and entities.[84]

Madoff's lawyer, Ira Sorkin, filed an appeal, and prosecutors responded with a notice of opposition. [84] On March 20, 2009, an appellate court denied Madoff's request to be released from jail and returned to home confinement until his June 29, 2009, sentencing. On June 22, 2009, Sorkin hand-delivered a customary pre-sentencing letter to the judge requesting a sentence of 12 years, because of tables cited from the Social Security Administration that his life span is predicted to be 13 years.[75][85]

On June 26, 2009, Chin ordered Madoff to forfeit $170 million in assets. Prosecutors asked Chin to sentence Madoff to the maximum 150 years in prison.[86][87][88] Irving Picard indicated that "Mr. Madoff has not provided meaningful cooperation or assistance."[89]

In settlement with federal prosecutors, Madoff's wife Ruth agreed to forfeit her claim to US$85 million in assets, leaving her with $2.5 million in cash.[90] The order allowed the SEC and Court appointed trustee Irving Picard to pursue Ruth Madoff's funds.[89] Massachusetts regulators also accused her of withdrawing $15 million from company-related accounts shortly before he confessed.[91]

In February 2009, Madoff reached an agreement with the SEC, banning him from the securities industry for life.[92]

Picard has sued Madoff's sons, Mark and Andrew, his brother Peter, and Peter's daughter, Shana, for negligence and breach of fiduciary duty, for $198 million. The defendants had received over $80 million in compensation since 2001 and "used the bank account at BLMIS like a personal piggy bank." The trustee believes they knew about the fraud because of their personal investments in the scheme, the longevity of the fraud, and because of their work at the company including roles as corporate and compliance officers. Since 1995, Peter Madoff had invested only $14, but withdrew over $16 million. Mark and Andrew Madoff withdrew more than $35 million from a small original investment.[93][94]

Mechanics of the fraud

According to the Securities and Exchange Commission indictment against Annette Bongiorno and Joann Crupi, two back office workers who worked for Madoff, they created false trading reports based on the returns that Madoff ordered for each customer.[95] For example, once Madoff determined a customer's return, one of the back office workers would enter a false trade from a previous date and then enter a false closing trade in the amount of the required profit, according to the indictment.[96] Prosecutors allege that Bongiorno used a computer program specially designed to backdate trades and manipulate account statements. They quote her as writing to a manager in the early 1990s "I need the ability to give any settlement date I want."[95] In some cases returns were allegedly determined before the account was even opened.[96]

Madoff admitted during his March 2009 guilty plea that the essence of his scheme was to deposit client money into a Chase account, rather than invest it and generate steady returns as clients had believed. When clients wanted their money, "I used the money in the Chase Manhattan bank account that belonged to them or other clients to pay the requested funds," he told the court.[97]

Affinity fraud

Affected institutions include Kentucky University, the Women's Zionist Organization of America, the Elie Wiesel Foundation and Steven Spielberg's Wunderkinder Foundation. Jewish federations and hospitals have lost millions of dollars, forcing some organizations to close.[98] The Lappin Foundation, for instance, was temporarily forced to halt operations because it had invested its entire $8 million endowment with Madoff. Affected institutions also include Stony Brook University Foundation and the James Harris Simons family foundation.

Size of loss to investors

David Sheehan, chief counsel to trustee Picard, stated on September 27, 2009, that about $36 billion was invested into the scam, returning $18 billion to investors, with $18 billion missing. About half of Madoff's investors were "net winners," earning more than their investment. The withdrawal amounts in the final six years are subject to "clawback" (return of money) lawsuits.[5]

Former SEC Chairman Harvey Pitt has estimated the actual net fraud to be between $10 and $17 billion.[99] Erin Arvedlund, who publicly questioned Madoff's reported investment performance in 2001, stated that the actual amount of the fraud will never be known, but is likely between $12 and $20 billion.[100] [101] As of September 2010 approximately $1.5 billion have been recovered for distribution to the net losers that were invested in BLMIS directly. Mr. Picard currently has approved approximately $5.6 billion in claims.

Plea, sentencing, and prison life

On March 12, 2009, Madoff pleaded guilty to 11 federal offenses, including securities fraud, wire fraud, mail fraud, money laundering, making false statements, perjury, theft from an employee benefit plan, and making false filings with the SEC.[102] The plea was the response to a criminal complaint filed two days earlier, which stated that over the past 20 years, Madoff had defrauded his clients of almost $65 billion in the largest Ponzi scheme in history. Madoff insisted he was solely responsible for the fraud.[6][77] Madoff did not plea bargain with the government. Rather, he pleaded guilty to all charges. It has been speculated that Madoff plead guilty because he refused to cooperate with the authorities in order to avoid naming any associates and conspirators who were involved with him in the Ponzi scheme.[103][104]

On November 3, 2009, David Friehling, Madoff's accounting front man plead guilty to securities fraud, investment adviser fraud, making false filings to the Securities and Exchange Commission, and obstructing the IRS. Madoff's right hand man, Frank DiPascali pleaded guilty in August, 2009, and is awaiting bail.[105]

Madoff's plea allocution stated he began his Ponzi scheme in 1991. He admitted he had never made any legitimate investments with his clients' money during this time; instead, he deposited the money into his personal business account at Chase Manhattan Bank. Chase and its successor, JPMorgan Chase, may have earned as much as $483 million from his bank account.[106][107] He was committed to satisfying his clients' expectations of high returns, despite an economic recession. He admitted to false trading activities masked by foreign transfers and false SEC filings. He told the Court his intention had always been to resume legitimate trading activity, but it proved "difficult, and ultimately impossible" to reconcile his client accounts. In the end, Madoff said, he realized that his scam would eventually be exposed.[83][108]

On June 29, 2009, Chin sentenced Madoff to the maximum sentence of 150 years in federal prison.[7][109] Madoff's lawyers originally asked the judge to impose a sentence of 7 years because of Madoff's old age.

Madoff apologized to his victims, saying, "I have left a legacy of shame, as some of my victims have pointed out, to my family and my grandchildren. This is something I will live in for the rest of my life. I'm sorry." He added, "I know that doesn't help you," after his victims recommended to the judge that he receive a life sentence. Chin had not received any mitigating letters from friends or family testifying to Madoff's good deeds. "The absence of such support is telling," he said.[110]

Chin also said that Madoff had not been forthcoming about his crimes. "I have a sense Mr. Madoff has not done all that he could do or told all that he knows," said Chin, calling the fraud "extraordinarily evil," "unprecedented" and "staggering," and that the sentence would deter others from committing similar frauds.[111] Chin also agreed with prosecutors' contention that the fraud began at some point in the 1980s, and also noted that Madoff's crimes were "off the charts" since federal sentencing guidelines for fraud only go up to $400 million in losses.[112]

Ruth did not attend court but issued a statement, saying "I am breaking my silence now because my reluctance to speak has been interpreted as indifference or lack of sympathy for the victims of my husband Bernie's crime, which is exactly the opposite of the truth. I am embarrassed and ashamed. Like everyone else, I feel betrayed and confused. The man who committed this horrible fraud is not the man whom I have known for all these years."[113]

Incarceration

Madoff's attorney asked the judge to recommend that the Federal Bureau of Prisons place Madoff in the Federal Correctional Institution, Otisville, which is located 70 miles (110 km) from Manhattan. The judge, however, only recommended that Madoff be sent to a facility in the Northeast United States.[114] Madoff was transferred to the Federal Correctional Institution Butner Medium near Butner, North Carolina, about 45 miles (72 km) northwest of Raleigh; he is Bureau of Prisons Register #61727-054.[1][115] Jeff Gammage of the Philadelphia Inquirer said "Madoff's heavy sentence likely determined his fate."[114]

Madoff's projected release date is November 14, 2139.[2][115] The release date, described as "academic" in Madoff's case, reflects a reduction for good behavior.[116] On October 13, 2009, it was reported that Madoff experienced his first prison yard fight with another senior citizen inmate. [117] When he began his sentence, Madoff's stress levels were so severe that he broke out in hives and other skin maladies soon after.[118]

On December 18, 2009, Madoff was moved to Duke University Medical Center in Durham, North Carolina, and was treated for several facial injuries. A former inmate later claimed that the injuries were received during an alleged altercation with another inmate.[119] Other news reports described Madoff's injuries as more serious and including "facial fractures, broken ribs, and a collapsed lung".[118][120] The Federal Bureau of Prisons said Madoff signed an affidavit on December 24, 2009, which indicated that he had not been assaulted and that he had been admitted to the hospital for hypertension.[121]

First Posted: 02/ 4/11 09:47 AM Updated: 02/ 4/11 11:38 AM

Greedy

Typical

Scary

Outrageous

Amazing

Innovative

Infuriating

So now we learn that senior executives with decision-making authority inside JPMorgan Chase -- the Wall Street behemoth that is supposedly run by the most mature of adults -- apparently suspected that Bernie Madoff was running an enormous Ponzi scheme even as they kept doing business with his firm. They supposedly kept funneling money his way and let him run cash through Chase accounts even as they were sending emails to one another reporting the creepy sense that the whole enterprise didn't look real. This, according to internal documents that came out in a lawsuit on Thursday.

We are presumably supposed to be shocked and horrified by this disclosure. Here is alleged evidence of a blurring of the lines between the legitimate, button-down world of high finance and the nefarious realm of a sprawling con game -- a scam run by a guy whose very name, Madoff, now goes down as a synonym for ripping people off on a grand scale.

But far from shocking, this is really just an appropriate plotline in a story that is finally becoming clear beyond argument: Those lines between criminal fraud and legitimate banking have been blurry for a long time. One can reasonably argue that they pretty much got erased during the Internet bubble and into the real-estate boom, when the regulators all went on vacation and the highest-paid bankers in the land ditched considerations of real value in favor of minting bogus stock issues and radioactive investment schemes. Financial shenanigans became the ultimate American product -- a lucrative enterprise for those up in the suites, and a disaster for everyone else.

Why might JPMorgan Chase have kept sending real money to Madoff even after it began to figure out that he wasn't running a real investment operation? You need not be Sherlock Holmes to crack this case. Other people were sending in gobs of money, too, and that meant there was money enough to pay off the earlier players. Same as in the Internet bubble, same as in the mortgage fiasco, the only real fools were the people who left their money in too long.

The longer the reckoning goes on, the more we learn about the complex derivative deals stitched together by geniuses inside enormous financial institutions, turning simple home loans into trillions of dollars worth of synthetic financial products backed by almost nothing, the clearer this reality becomes. The financial crisis was no natural disaster, as some apologists still claim. It was not the result of risk-management models getting swamped by complexity, or a dreamy belief that home prices could go up forever (though both of those factors certainly played a role). It was, in simplest terms, a hostile takeover of the vital organs of finance by people willing to destroy things of intrinsic value -- people's homes, real businesses, retirement savings -- so they could extract a cut.

The fact that we even call Wall Street a banking center now seems laughable. The real bankers are out in communities, enabling businesses to set up lines of credit so they can order raw materials and make payroll while they wait for their sales revenues to come in. Wall Street views that sort of thing as quaint and beside the point, a distraction from where the real action lies: buying up piles of whatever happens to be moving at any point in time -- subprime loans, complicated bets on the price of heating oil -- and dumping them on some other sucker at a higher price before reality intrudes, laying the economy to waste and then generally sticking taxpayers and working people with the tab.

Madoff has become a national obsession because he actually cheated people he knew, people he was close to, people with whom his family dined, people whose life's work was palpably entrusted to his safekeeping. At a time in which much of the country still strains for someone to blame for how the economy failed, Madoff, an easily-understood villain who apparently made off with all the money, often stands in as the ideal man for the job (even as the amount of money left missing, some $65 billion, amounts to chump change compared to the banking-led larceny committed at the expense of national prosperity).

Wall Street, on the other hand, prefers largely impersonal affairs. It buys up pools of mortgages from far and wide, then slices them into odd-sized bits and scatters them around the globe. The foundation that gave its money to Madoff and now doesn't have it anymore knows who took it. The homeowner in southern California who got tricked into a terrible mortgage written by Washington Mutual -- since taken over by JPMorgan -- and is now putting his stuff in boxes as his house disappears into foreclosure lacks the consolation of a coherent account of what went down.

And yet, on some level, those stories -- now fused -- have been the same all along, a reflection of a financial sector far more interested in investment fantasies than helping sustain a healthy economy. In the end, Madoff was merely running a smaller, clearly-illegal Ponzi inside a financial system that basically functioned like one all along

WikiLeaks Cable Suggests Saudi Arabia Is Running Low On Oil

http://www.huffingtonpost.com/2011/02/09/jpmorgan-chase-fires-back_n_820676.html

JPMorgan Chase Fires Back At Madoff Trustee

First Posted: 02/ 9/11 09:38 AM Updated: 02/ 9/11

(By Jonathan Stempel) JPMorgan Chase & Co accused the trustee seeking $6.4 billion for victims of Bernard Madoff's Ponzi scheme of doing an end run around the law in pursuing his case, and said it has a right to a jury trial.

The second-largest U.S. bank said court-appointed trustee Irving Picard is exceeding his power by suing in bankruptcy court, where a judge rather than a jury would decide the case.

"The trustee's massive damages action against JPMorgan bears no resemblance to a typical lawsuit commenced by a bankruptcy trustee," JPMorgan's lawyers said in a court filing late Tuesday.

"In substance," the bank said, "the trustee is trying to pursue an enormous back-door class action."

A spokesman for Picard did not immediately respond to a request for a comment.

JPMorgan asked U.S. Bankruptcy Judge Burton Lifland, who oversees the Madoff proceedings, to move Picard's lawsuit to federal district court, where it can demand a jury trial.